pay indiana state tax warrant

If the State does not receive notification that a payment plan has been established and is being met the State can recall the Tax Warrant and move on to other collection methods. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes.

Dor Owe State Taxes Here Are Your Payment Options

Our service is available 24 hours a day 7 days a week from any location.

. If you are going to pay the amount owed it needs to be paid using cash. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. Submit the form and well contact you with more information on how your Indiana County can benefit from ATWS.

About Doxpop Tax Warrants. To learn more about the EFT program please download and read the EFT Information Guide. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to.

A monthly payment plan must be set up. Questions regarding your account may be forwarded to DOR at 317 232-2240. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt.

How to pay your individual taxes online Sign in to your financial institutions online banking service for individuals. Doxpop provides access to over 13062400 current and historical tax warrants in 92 Indiana counties. INtax only remains available to file and pay the following tax obligations until July 8 2022.

1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. Tax Liabilities and Case Payments. Request a No-Obligation Consultation.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. DOR Tax Forms Online access to download and print DOR tax forms to file taxes unless otherwise specified or available via INTIME. Indiana Department of Revenue.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience. Enter your 9-digit social insurance number as your CRA account number.

Your name please spell your name on your message Tax Warrant. On the other hand it is a level 6 felony defined by Indiana Code 35-50-2-7 punishable by incarceration between six months to one-half 2 12 years and a fine penalty of up. Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS.

We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. Indiana Department of Revenue. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

This includes making payments setting up payment plans viewing refund amounts and secure. Leave a message with the following information. You should also know the amount due.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. ATWS is a software package that streamlines the handling of Indiana Tax Warrants. It is punishable by a year or less in jail and a fine penalty of up to 5000.

Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to. For more information call 317 232-5500.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Questions regarding your account may be forwarded to DOR at 317 232-2240. You can find information on how to pay your bill including payment plan options FAQs and more below.

These should not be confused with county tax sales or a. Set up a payment plan by calling 317-776-9860. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

EFT allows our business customers to quickly and securely pay their taxes. Tax payments over 100000 may come with special requirements and these payments must be processed over the phone instead of online. Under Add a payee look for an option such as.

CRA current-year tax return. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. 430 pm EST.

Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. Different types of tax payments come with a maximum number of times you can pay with a credit card each year. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability.

Employers federal tax deposits cannot be paid with a credit card. A tax warrant has been issued for failing to pay state taxes and this information is sent to us from the State of Indiana. Call 911 600 Memorial Drive.

Tax Warrant Division PO Box 663 Crawfordsville IN 47933.

Indiana Department Of Revenue Taxpayer Notification Sample 1

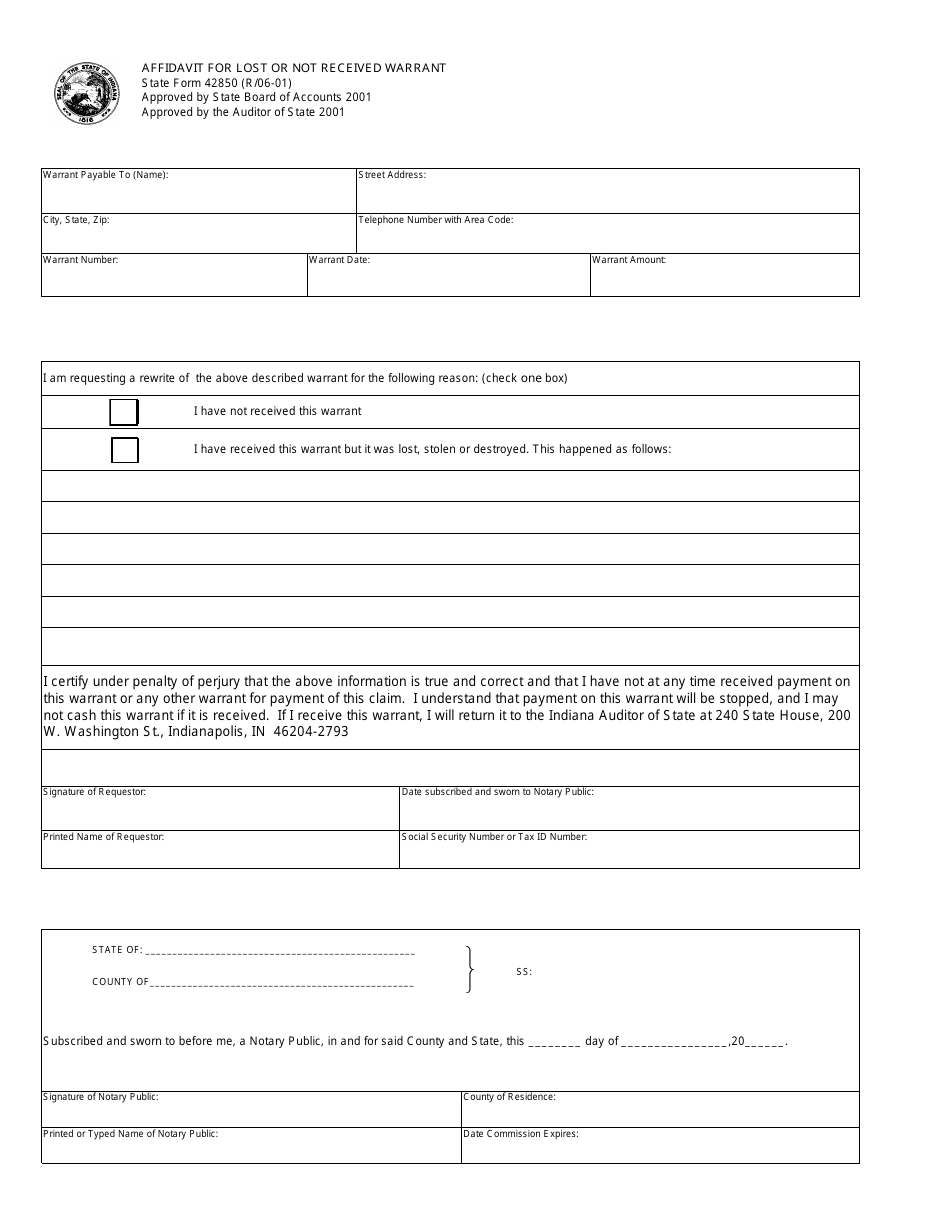

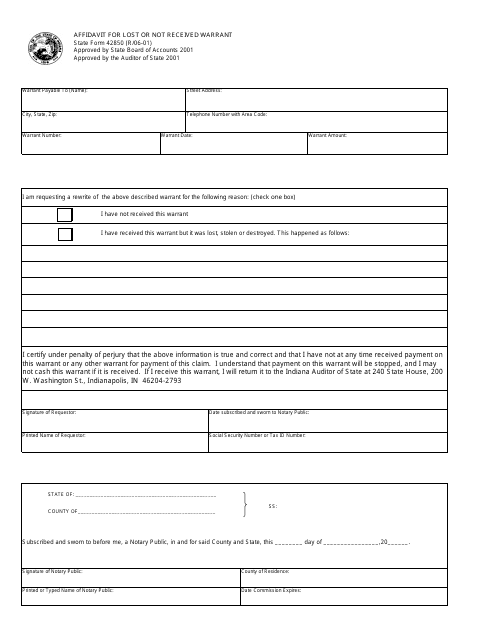

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

State Form 23037 Download Fillable Pdf Or Fill Online Affidavit Of Ownership For A Vehicle Indiana Templateroller

Indiana Department Of Revenue Taxpayer Notification Sample 1

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

Indiana Tax Relief Information Larson Tax Relief

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Dor Owe State Taxes Here Are Your Payment Options

Dor Indiana Extends The Individual Filing And Payment Deadline

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org